As a UX Designer, one will experience a multitude of industries across their career. Two of the most historically challenging areas, across the board, to assert major design change have been Healthcare and Financial.

When approaching an expansive operational change pitch, its important to succinctly addresses the major pain points from a creative/UX view when working with corporate stakeholders that have a seemingly opposite set of skills and expertise (ex. math vs. art).

The challenge becomes: how do we shift traditional “path of least resistance” thinking to a mindset visualizing the importance of forward progress?

The following ten strategy points are key to informing a current and/or future financial services client of the progressive mindset behind updating their UX infrastructures:

1. View Design As A Methodology, Not a Package

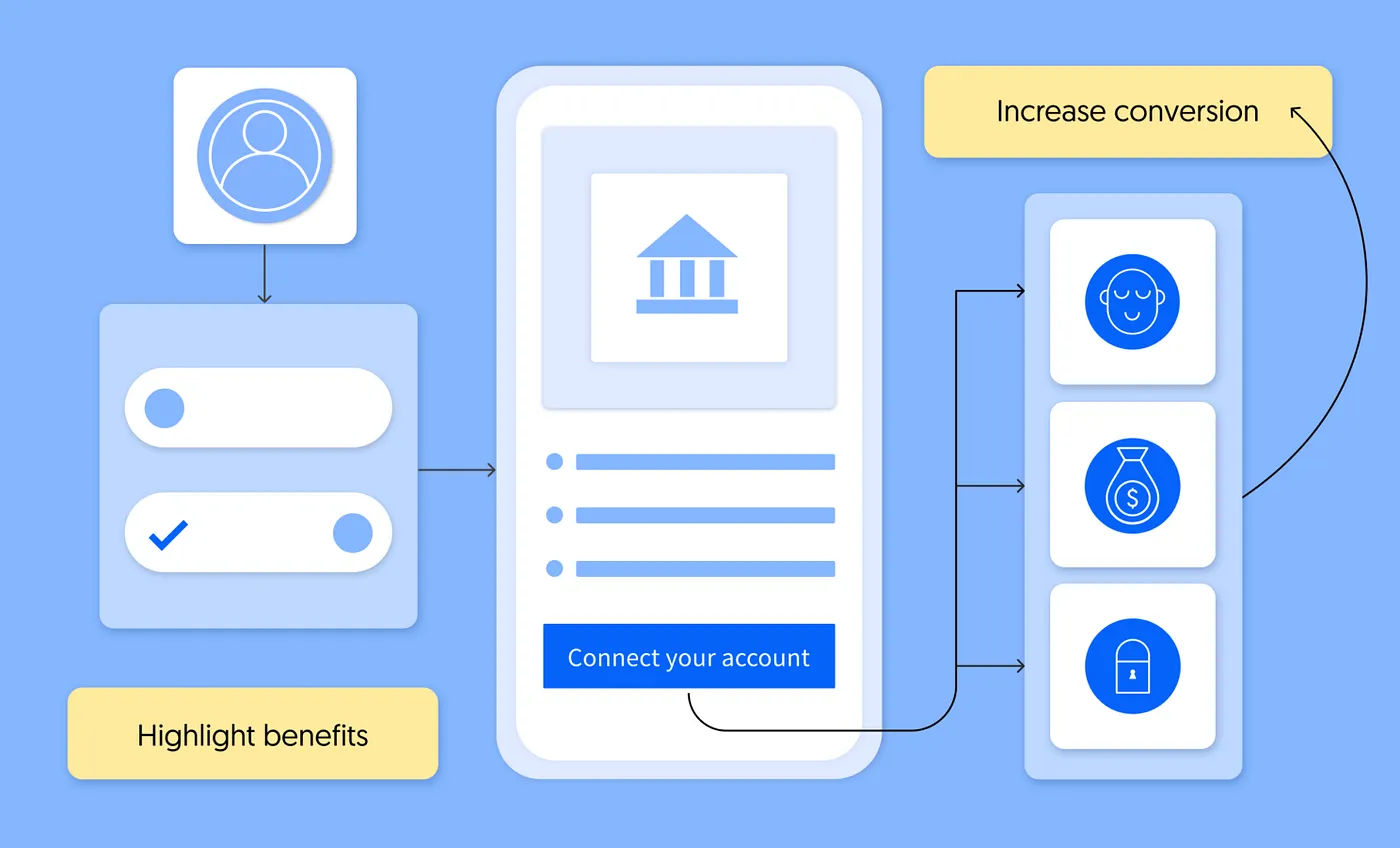

Banks and financial institutions perceive design as a package while fintechs see design as a consumer-centered approach, but let’s call it what it is; a lack of understanding.

Design has been viewed by many clients as “paint” and not “structure,” and that is specifically why it’s so important to educate stakeholders on Design Thinking and Methodologies. It is so much more than making a logo, picking colors, and playing with fonts.

Design-based decision-making should not be led by Product Owners, Project Managers, Developers, Engineers, or even Stakeholders. They can provide unique perspectives, present opinions on research, provide reasonable requirements, all while engaging with in-depth data and applicable feedback. But the rest should be in the hands of the Designer.

2. Increase The Scope Of UX Design Influence

UX experts are trained to be user-centric while curating and crafting experiences that ensure user satisfaction and delight. Thinking that “anyone can do this” is pure hubris. Yes, everyone can be creative. No, not everyone is good at it.

Hire the right talent and give them the freedom to explore.

Financial apps must be about ease-of-use and intuitiveness before tackling how pretty it looks or stuffing as many features in as possible. UX, as a design method, ensures that the user is fairly represented against the requirements of the need. Stakeholders typically have strong opinions on design, but they aren’t likely to be the ones using it everyday. It’s acceptable to push back, but you should have the research to support it.

3. Challenge The Banking Legacy

We should remember that it takes two — Product Owners and UX Leads should be solidified as the cornerstone of every good project from the very beginning. You need both of them to always be present: the client advocate and the user advocate.

Traditional corporations rely on structured hierarchy to get things done. However, inserting the pragmatism of Design allows for individual agency and decision-making to happen on a more detailed level and that is where the trust is needed. Your UX folks are smart. Let them do their thing.

The core takeaway is that UX people are needed before the project kicks off and should remain attached during the entire duration to capture data, extrapolate findings, align with visuals, and prepare to iterate on the next version. They help tie it all together. Let the User Experience team understand how users experience your product.

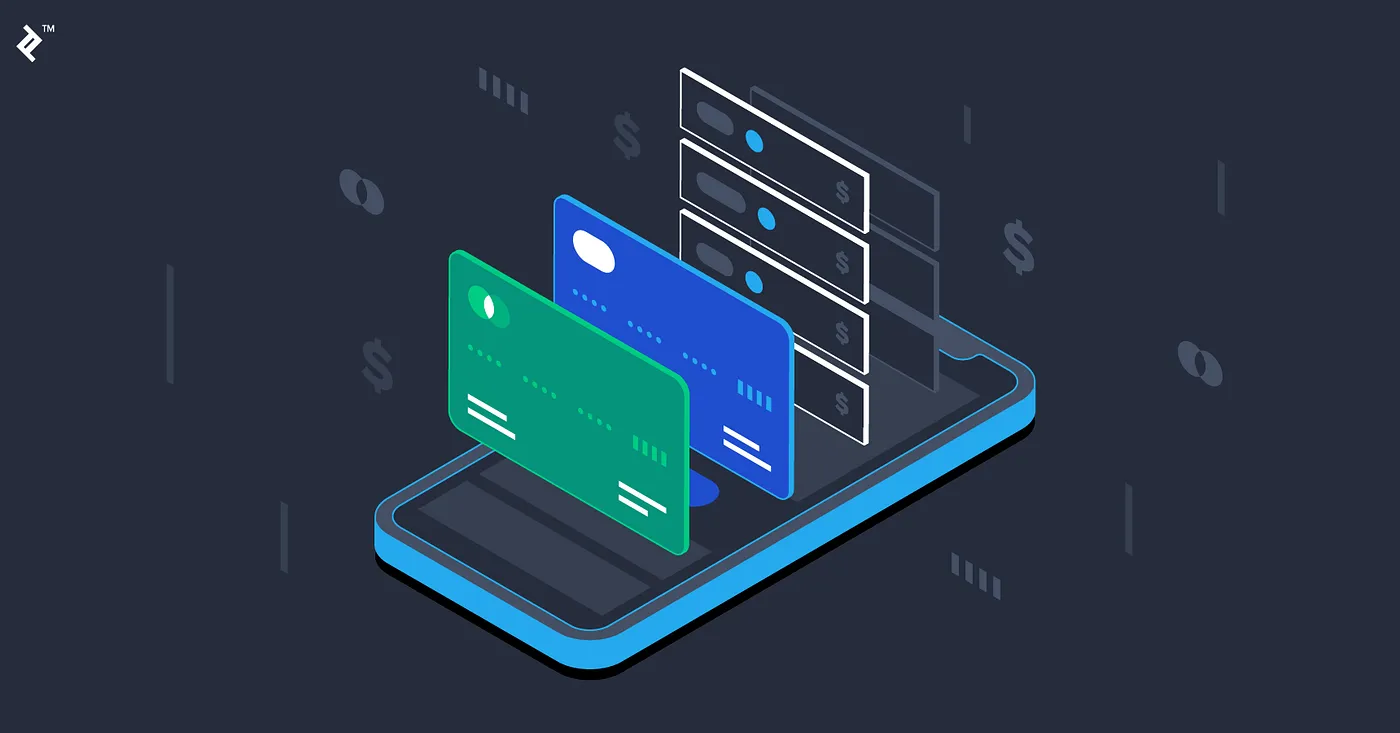

4. Switch From Fragmentation To Ecosystem

“Fintech”, as a label, is shifting to include any new products and/or brands that are promoting digital as the main primer for change within their organization and offerings. Banks are resistant to this type of change simply due to how their control of wealth is dependent on small static changes over long periods of time: Take money, sit on it, make interest, share dividends.

Fintech is breaking down walls that banks cannot adapt to, like cryptocurrency, DeFi, and other new concepts. Not all banks have invested in fintech, but all fintech have some form of banking service.

Many traditional banks failed due to the inability to accept rapid evolutions as they typically desire stability and slow, predictable movement. That’s what happened in the mid-2000s when small banks couldn’t invest in online banking in a reasonable timeframe and/or provided a poor user experience. They “stayed the course” right into getting absorbed by larger entities to survive.

We know that embracing flexibility and new ideas can be risky, but a good risk assessment will show massive gains for a healthy investment in UX Research and Design.

5. Put UX Research First

Fintech excels in Product Design which culminates research and data into a cohesive and consistently built system from the very beginning of the brand’s inception.

Naturally, creating multiple services on one product can be hard. The FDIC says you need this, InfoSec says you need that, Engineering wants to save time and use a 3rd-party API/iFrame, and so on. We are challenged to be in compliance and have a beautiful application for users to intuitively engage with. But that’s the reason why it’s so important to invest in your UX teams!

Make sure that you have the data to support a unified system of products and services while maintaining a Design Language to keep everything looking and operating the same on every page for every user. Consistency matters!

6. Provide A Unique Value Proposition

Even if you’re “copycatting” products from other systems, your users are different and finding out what their needs are will increase engagement much more than assumptive design ever could. If you don’t know what people think of your product, you’ll never be able to pivot in the right direction. When they move, you move, just like that. There’s a big difference between qualitative and quantitative feedback.

Everyone wants to try to cram their entire product offering into a single app. It’s wonderful to have, but sometimes it’s just plain impossible to accomplish with the time and resources you’ve been given. We can’t always “make it fit’’ for everyone. The honest truth is that it won’t ever work for everyone and the individuality of your target demographics and focused segmentation should be the most valuable asset in your research arsenal.

Yes, you need a unique value prop, but only if it directly benefits your audience in a positive and engaging way. You want people to tell others about your product in a satisfied way. Bad reviews always lead to abandonment.

Take some time to compare what fintech and your direct competition is doing well and filter out how you can emulate those good ideas while staying on-brand and on-message. A good designer can help translate this information into a fully realized and custom experience.

7. Drop The Obsession With Banking Functionality

We should try to fit in as much functionality as possible, but not at the expense of the product or its users.

Every customer should have a journey that offers a simple “happy path” to completion. In finance, complexity can often be a source of pride and exclusivity. That may not be the case with all of your customers.

8. Measure Results By Quality, Not Quantity

Quality vs. Quantity is not a thing anymore. It’s instead the marrying of the two ideals of Quality and Quantity in a cohesive and engaging way.

The qualitative research that needs to be done should be exponentially impacted by the quantitative surveys and analytics gathered during initial research. For examples, we may lose quality when speed is priority, however this is why rapid user testing and prototyping is so important.

Test, review, rinse, repeat.

9. Focus On Emotions Instead Of Information

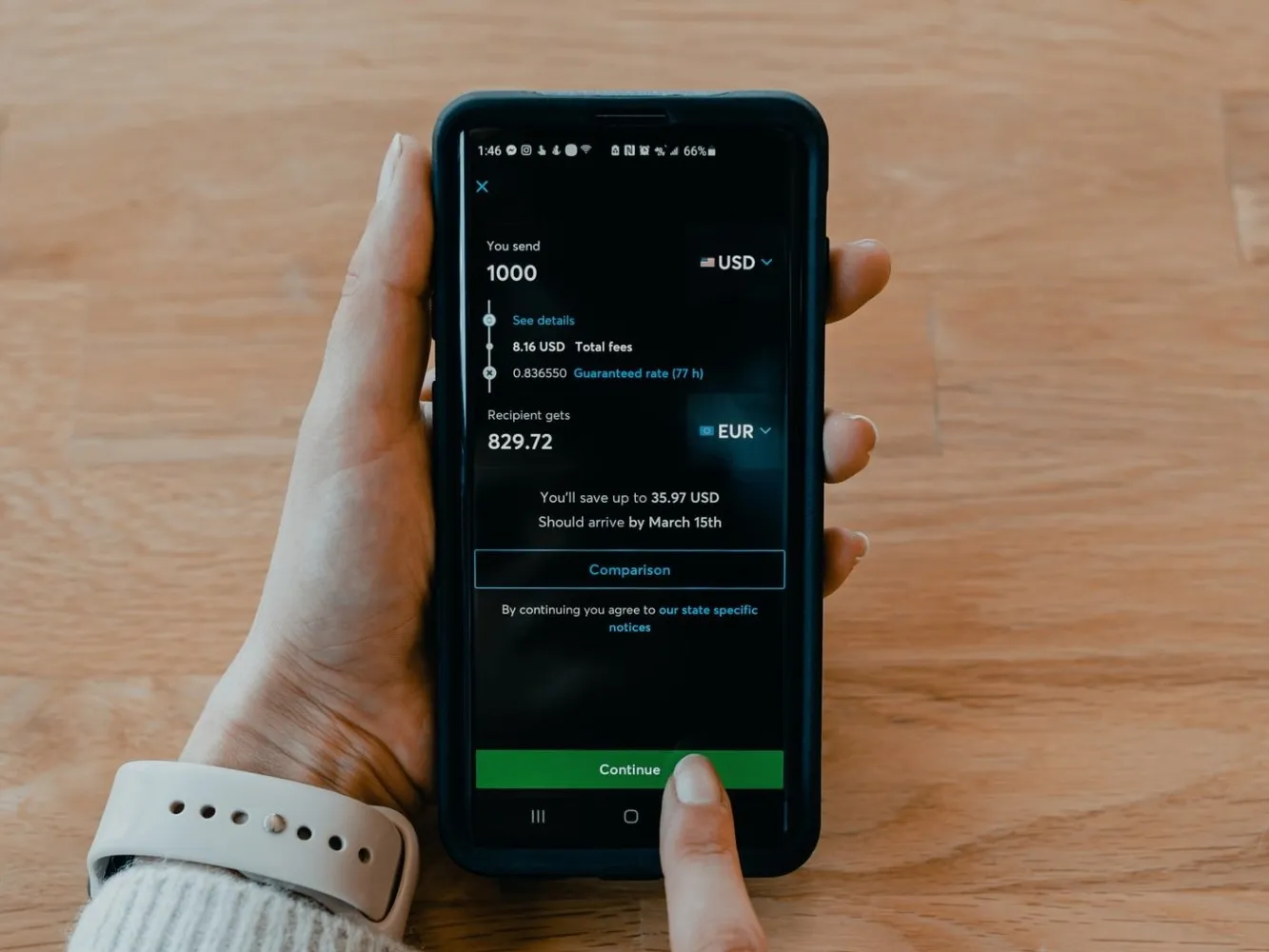

Empathy will always be key. People have emotional connections to their finances and the institutions they invest that buying power into. Banks tend to overwhelm people with unfamiliar paperwork, nomenclature, acronyms, and fine print.

The future of finance is making informed decisions based on simplified communication and customer loyalty. Keeping the complex curtains up will keep curious people away.

10. Invest More In Customer Experience Than In Marketing

The customers you have are worth more than the ones you lack. Marketing tends to focus on garnering new business while maintaining existing relationships are not as much of a priority. And that’s OK! But maintaining long financial relationships with contented customers far outweighs the risk of that unknown potential.

Let your product speak for itself through accessibility, effective UI, and an intuitive landscape. You want people to recommend your product to others. Curiosity and satisfaction go hand-in-hand; if you’re interested in something, would you rather find out about it from a banner ad, or several different family members and friends who all gave it glowing reviews?

Closing Thoughts

UX, UI, Design, and Creative are not as highly valued or involved at an early enough stage of the project to make an impact. Financial companies tend to relegate those team members to Production Art and QA Maintenance asks due to a lack of understanding of how effective and powerful adding UX Designers can be. Keeping them out of the project loop will not only dull their edges, but have them looking for new roles elsewhere.

Fintech teaches us that looking at finance in a customer-centric way is effective, profitable, and mirrorable at the corporate scale for banking.